Traceloans.com bad credit services cater specifically to individuals struggling with poor credit scores, offering a lifeline to those who face barriers in traditional lending systems. This platform has become a trusted resource for securing loans tailored to the unique needs of borrowers with less-than-perfect credit histories. For anyone seeking transparent, accessible loan options, The bad credit serves as an invaluable tool.

Why Choose Traceloans.com Bad Credit?

Borrowers with bad credit often face limited options in the financial marketplace. The bad credit services stand out by addressing this gap with solutions designed to accommodate diverse financial situations. The platform’s streamlined processes, competitive terms, and borrower-centric policies make it a preferred choice for many.

The Benefits of Using Traceloans.com Bad Credit Services

The advantages of turning to traceloans.com bad credit extend far beyond mere accessibility. The platform emphasizes ease of use, quick approvals, and flexible repayment terms, ensuring a positive borrowing experience for all users.

Accessibility for All Borrowers

Unlike traditional lenders, traceloans.com bad credit focuses on the needs of borrowers who may not meet conventional credit requirements. This inclusivity makes financial relief attainable for a wider audience.

Flexible Loan Terms

Borrowers are offered customizable repayment plans that align with their financial capabilities, reducing the risk of default.

Fast and Transparent Approvals

Applications on the platform are processed swiftly, with clear communication at every stage. Transparency is prioritized, ensuring borrowers fully understand their terms.

Types of Loans Available on Traceloans.com Bad Credit

Traceloans.com bad credit provides a variety of loan options to meet different financial needs. Whether seeking short-term solutions or more substantial loans, borrowers can find the right fit.

Personal Loans for Bad Credit

Personal loans offered through traceloans.com bad credit are tailored to help borrowers manage expenses such as medical bills, home repairs, or unexpected emergencies.

Payday Loans

Payday loans are an option for those who require smaller sums with shorter repayment periods. These loans provide immediate relief for urgent financial needs.

Secured and Unsecured Loans

Borrowers can choose between secured loans, which require collateral, or unsecured loans, which do not. This flexibility ensures that options are available for individuals with varying resources.

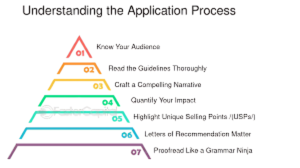

Understanding the Application Process

The application process on traceloans.com bad credit is designed to be straightforward and user-friendly. By following a few simple steps, borrowers can quickly access the funds they need.

Prequalification

Borrowers begin by completing a prequalification form that requires basic information, including income details and desired loan amounts. This step helps determine eligibility without impacting credit scores.

ubmission of Documentation

Once prequalified, applicants submit necessary documentation such as identification and proof of income. This process ensures that loans are tailored to the borrower’s financial situation.

Approval and Disbursement

After the application is reviewed, borrowers receive prompt approval notifications, with funds typically disbursed within 24 to 48 hours.

Tips for Maximizing Success with Traceloans.com Bad Credit

Borrowers who approach the loan process strategically often achieve better outcomes. The following tips can help users of traceloans.com bad credit secure loans effectively.

Maintain Honest Communication

Providing accurate information during the application process is crucial. Transparency ensures that terms are appropriately tailored.

Consider Repayment Capacity

Borrowers should evaluate their financial situation realistically and select repayment terms that align with their budget.

Stay Informed About Terms and Conditions

Reading the fine print and understanding all aspects of the loan agreement can prevent misunderstandings later.

The Importance of Bad Credit Loans

For individuals with poor credit, loans can serve as a stepping stone toward financial stability. Traceloans.com bad credit enables borrowers to access funds while rebuilding their credit profiles through timely repayments.

Improving Credit Scores

By consistently meeting repayment obligations, borrowers can gradually improve their credit scores, opening doors to better financial opportunities in the future.

Managing Emergency Expenses

Loans provide a financial buffer during emergencies, ensuring that borrowers can address urgent needs without undue stress.

Common Concerns About Bad Credit Loans

Borrowers often have questions about bad credit loans, and traceloans.com bad credit addresses these concerns through transparent communication and supportive services.

Will Interest Rates Be Higher?

While bad credit loans may have higher interest rates, traceloans.com bad credit strives to offer competitive terms that minimize costs.

Are Collateral Requirements Strict?

Collateral is not always required. Borrowers can opt for unsecured loans based on their preferences and qualifications.

Can Loans Be Repaid Early?

Early repayment is often allowed, providing borrowers with the flexibility to close their loans ahead of schedule without incurring penalties.

FAQs

What makes traceloans.com bad credit different from other lenders?

The platform focuses on borrowers with poor credit, offering tailored solutions that emphasize accessibility and flexibility.

Are traceloans.com bad credit loans safe?

Yes, the platform prioritizes security and transparency, ensuring that all transactions are conducted safely.

How quickly are loans approved on traceloans.com bad credit?

Most loans are approved within 24 to 48 hours, with funds disbursed promptly after approval.

Can I apply for a loan if I’m self-employed?

Yes, self-employed individuals can qualify by providing proof of consistent income.

What happens if I miss a repayment?

Borrowers should communicate with the platform immediately to discuss possible solutions, such as revised repayment plans.

Is there a limit to how much I can borrow?

Loan limits depend on factors such as income, credit history, and the type of loan chosen.

How does traceloans.com bad credit handle customer support?

The platform offers responsive customer support, ensuring that all borrower concerns are addressed promptly.

What documentation is needed to apply for traceloans.com bad credit?

Basic identification, proof of income, and financial statements are typically required to complete the application process.